Enable your customers

Mobile Banking is changing lives

Give your customers the flexibility to bank at their convenience and keep finances as close as they need to be-- in their pocket. The ease of self-banking at their fingertips gives them more time for other things, making them truly mobile.

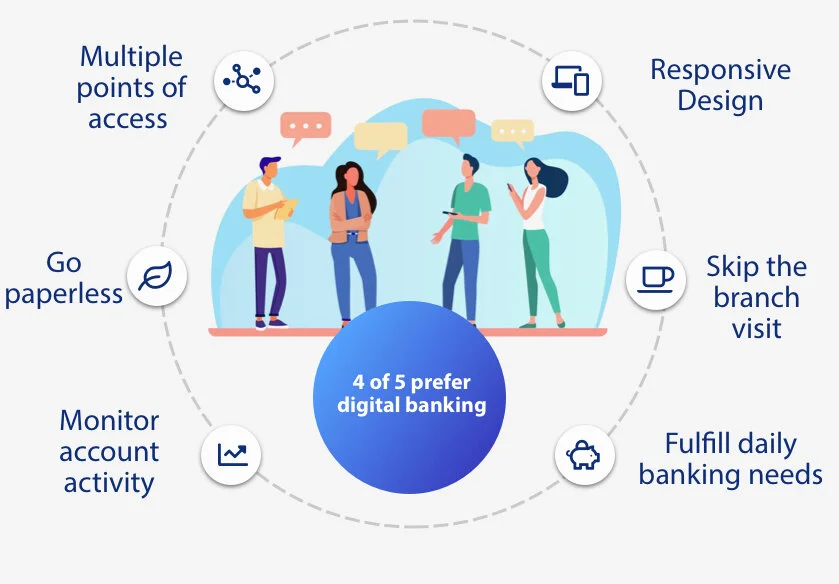

The power of digital banking.

4 out of 5 prefer digital banking than visiting a physical branch, which explains why improving mobile and online banking is so important. Better digital services mean happier customers and we can help you achieve this.

Our digital-first solutions will give your customers the user experience they are looking for and exceed their expectations.

Responsive Design across all platforms

Skip the branch visit - Self-serve access to product applications and documents

Fulfill daily banking needs conveniently from anywhere

Monitor account activity and take control

Go paperless and download history and statements

Multiple points of access for online support

“Customers with high mobile banking satisfaction are more likely to recommend their banks to others as well as reuse a bank for another product than customers who do not use a banking app.”

The future of customer engagement is mobile.

Stay ahead of the competition and give your customers innovative digital services from a world wide leader in secure mobile apps.

Built with both security and ease of use as design goals, our web banking solution is a delight to use.

Our web banking is a turnkey solution that allows customers to bank any time, anywhere. Our solution provides you a fully branded, robust and secure web platform with all of the standard banking features you would expect from a top-notch Internet banking site and so much more.

Quick and convenient, text banking with SMS allows banking from any text-enabled phone, essential for those with limited data plans.

Mobibanking text app gives real-time access to your accounts. It's fast, easy and simple to use. It's secure and your personal information is always safe.

Mobile Banking - The Way It Should Be

Life is full of moments. It is these snippets of time that beautiful memories are created. Whether it is embracing time with our loved ones, celebrating special occasions or even capturing milestones--these experiences bring joy to our lives. Save precious time with mobile banking and give yourself the freedom of mobility. The time is yours. Cherish every moment and be worry-free.

Do more with MobiBank

Take full control of your finances and utilize the features to do more than just banking. Set up the Text channel to perform banking on the go, get alerts that notify you of important transactions, set up scheduled transfers to accumulate savings for children or grandchildren. It’s your money, make it meaningful.

Streamline

Streamline processes and make financial services easily accessible for clients.

Reduce Branch Traffic

With digital banking, clients can do banking at the touch of their fingers and don’t need to go to the physical branch, reducing line-ups and freeing up employees for other tasks.

Reduce Costs

Did you know the average office worker uses 10,000 sheets of copy paper each year? Switch to digital and save your bottom line.

Self-service Anytime

Always be open for business. Give clients access to services at their convenience.

Grow

Make it easy for clients to do business with you. Build client relationships and watch your business grow.

MobiBank paired with MobiBranch gives customers the convenience of self-service, anywhere and any time.

Customers can start applications but then request help from an employee at any time and documents can move freely back and forth for signature and edits.

Speak with a Mobilearth expert today for a demo and learn about the options for your customers.

Mobilearth has been trusted by financial institutions worldwide since 2005. Contact us today for more information.